By Jeff Gilbert

Defining financial success is a hard thing to do. Some people consider financial success to be a feeling of reassurance and safety, while others consider financial success to be a symbol of status and power. However you choose to define success is completely up to you, but there are certain core habits and behaviors that will get you there. In this article, we’ll explore the top 6 habits to keep in mind if you’re trying to achieve financial success.

1. Cultivate Financial Confidence

One of the best habits to build is financial confidence. Many people define financial confidence by how much money you have (i.e., having money gives you financial confidence). But it’s actually the opposite. Feeling confident in your ability to save money, build wealth, and make wise financial decisions is what brings financial confidence (and ultimately financial success), not the other way around.

Making the conscious mindset shift from one of cynicism and doubt to one of determination and confidence can make a huge difference in your ability to achieve your goals. In fact, recent research suggests that a positive outlook on your own ability to accomplish something makes you more likely to actually accomplish it. (1)

Don’t be afraid to dream big financially. You have the power to achieve your goals by proactively planning, dreaming, and strategizing. Think of your most lofty financial goal and break it down into smaller substeps. Does it sound impossible to save $100,000 in five years? Think of saving $20,000 every year instead. It’s easy to get discouraged when it feels that substantial progress is so far away. So, try acknowledging and celebrating small milestones along the way. This can help you stay motivated to keep working toward your goals.

2. Improve Your Financial Literacy

Another great way to achieve financial success is through improving your financial literacy. It sounds cliche, but there is a reason the saying “Knowledge is power” is so commonly quoted. As with any topic, the more you know about finance, the more likely you are to make wise financial decisions. Sure, you can hire financial professionals to advise you along the way (see point #6), but nothing beats having a sense of agency over your own finances. You can rely on professionals, but you should also rely on yourself to grow your financial understanding and improve your financial literacy.

Reading books by financially successful people, listening to podcasts, reading magazines like The Economist and Kiplinger’s, or taking a financial education course are just a few ways to take your financial future into your own hands and improve your chances of achieving financial success.

3. Avoid Everyday Debt

You’ve probably heard it said that wealthy people avoid debt like the plague. Financially successful people live by this concept, understanding that credit should be used sparingly and not as a way to live beyond your means.

Credit can be a useful financial tool when purchasing large assets that will appreciate and bring value down the line (like a house), but it can be a slippery slope if used for everyday expenses or things you don’t need. Avoid overburdening your finances with credit card debt, and if you do use credit, make sure the balance is paid off every month. Revolving credit card debt is the quickest way to rack up interest charges and fees that can take years to pay off, which makes it exponentially harder for you to achieve true financial success.

Try shopping without your credit cards and planning ahead for large purchases instead. Minimizing the amount you have to borrow and creating a repayment plan are two ways to avoid the trap of everyday debt.

4. Don’t Keep Up With the Joneses

While you do want to follow the good financial habits of successful people, you don’t want to get caught up in thinking that your life needs to look exactly like theirs. This is especially true when you are working toward a certain lifestyle. You won’t be able to afford that lifestyle right away, so don’t feel pressure to keep up with the Joneses.

In today’s social-media-driven age, it can be tempting to compare yourself to your peers, feeling pressure to surround yourself with nice furniture, designer clothes, expensive cars, grand vacations, and the latest technology. But these items will only set you back in your quest for financial success, especially if they were funded with everyday credit (see point #3).

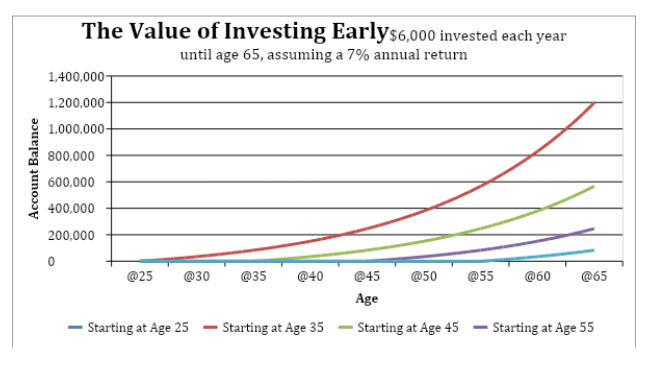

Financial success is often built from doing the things that other people don’t want to do: tracking expenses, minimizing your spending, saving and investing religiously, etc. These small habits, when done consistently over time, will generate compounding growth and provide the framework you need for financial success.

5. Manage Your Risk

There are many ways a financial plan can be derailed. Whether this comes in the form of investment risk (hello, market volatility!), health risk, auto, liability, or homeowner risk, properly managing these potential obstacles is one of the most important ways to protect your accumulated wealth and build financial success. You can have a sizable amount saved, but it can be wiped out in an instant if you get sick, get in an accident, or experience any number of financial curveballs life may throw.

The good news is that though there are seemingly endless risks out there, many of them can be mitigated through proper insurance and estate planning. Get in the habit of regularly checking your insurance coverage amounts to ensure they’re adequate enough to protect what you’ve already built. Consider an estate plan to protect your wealth in the event of incapacity or death, and don’t forget that making sure you’re adequately covered now will save you time, money, and energy in the future.

6. Seek the Guidance of a Professional

Though many of these points mention the importance of building your own financial confidence and literacy, working with a financial professional is also a great way to achieve financial success. Not only are financial advisors a good resource for additional financial education, they can also help you stay on track and hold you accountable to the goals you want to achieve.

Advisors have access to industry tools, technology, and continuing education that make tracking, implementing, and projecting the overall state of your financial plan much easier and much more accurate than if you were to do it completely on your own. Consider working with an advisor you trust to maximize your potential to achieve financial success.

Take the Next Step in Your Journey to Financial Success

Are you ready to take the next step in your journey to financial success? To learn more about how Balboa Wealth Partners can help you achieve financial confidence through these habits and more, call me at 949-445-1465 or email me at jgilbert@balboawealth.com for a complimentary, no-obligation conversation.

About Jeff

Jeff Gilbert is the founder and CEO of Balboa Wealth Partners, a holistic financial management firm dedicated to providing clients guidance today for tomorrow’s success. With nearly three decades of industry experience, he has worked as both an advisor and executive level manager, partnering with and serving a diverse range of clients. Specializing in serving high- and ultra-high-net-worth families, Jeff aims to help clients achieve their short-term and long-term goals and to worry less about their finances and more on their passions in life. Based in Orange County, he works with clients throughout Southern California, as well as Arizona, Oregon, and Washington. To learn more, connect with Jeff on LinkedIn or email jgilbert@balboawealth.com.

Advisory services provided by Balboa Wealth Partners, Inc., an Investment Advisor registered with the SEC. Advisory services are only offered to clients or prospective clients where Balboa Wealth Partners and its Investment Advisor Representatives are properly licensed or exempt from registration.

Securities offered through Chalice Capital Partners, LLC, member FINRA, SIPC.

Balboa offers advisory services independent of Chalice. Neither firm is affiliated.

_____________

(1) https://medium.com/swlh/3-scientific-studies-that-prove-the-power-of-positive-thinking-616477838555