How To Prepare For Volatility In The Market

By Jeff Gilbert

Here’s the thing: Even though we had been enjoying our record-long bull market and knew that it couldn’t last forever, no one saw our current situation coming. For example, when we turned the page of our calendar to 2020, analysts predicted modest returns (1) and the financial world saw little risk of a recession.

But just because we didn’t see this coming doesn’t mean you are powerless. While the severity of our current events is not to be minimized, we can battle fear and anxiety by going beyond the headlines and educating ourselves with the facts. With that in mind, here are 4 ways to prepare your finances for more volatility.

1. Keep A Level Head

Times of uncertainty are not ideal for making drastic changes or decisions. In today’s digital world, we have 24/7 access to news media outlets, and there are a lot of them. With so many different voices fighting for our attention, headlines are getting more and more alarmist. We are constantly bombarded with articles and videos telling us what we need to do based on the last hour’s market performance.

That’s why one of the worst things you can do in a volatile market is let your emotions drive your actions. Volatile times call for a logical outlook. Remember: The numbers you see in your account are just that—numbers. They don’t mean anything unless you sell. Don’t let fear get the best of you. This brings me to my second point.

2. Consider Long-Term Results

Instead, stick to your long-term perspective. The market might be down tomorrow and it might be down a month from now. But if you needed your money tomorrow or a month from now, you wouldn’t have invested it in the stock market. Stock market investing is for the long term, so you shouldn’t let short-term volatility scare you. Volatility and market drops will only hurt you if you panic sell when the market is down and lock in those losses.

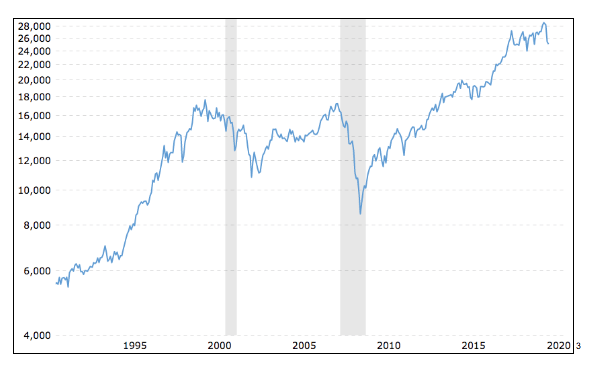

History shows us that about every four years the markets post negative annual returns. In spite of that, the S&P 500 Index has averaged gains of 12% from 1979 to 2019. (2) Here is a graph that shows this long-term stability, despite short-term market fluctuations. This is the Dow Jones Industrial Average (DJIA) showing over the last 30 years of investment value, which is a fair representation of the market as a whole if you are an average investor.

If you remember the 2008/2009 crash, as seen above, the market recovered well. The market always recovers, and it will continue to do so.

3. Trust Your Portfolio

Markets go up and down, and investment professionals understand the movements and prepare for them. If you’re a client of ours, then we designed your portfolio with this in mind. We knew it would happen and you are ready for it.

Just because the Dow Jones Industrial Average is bouncing all over the place doesn’t mean that your portfolio is. Your portfolio consists of not just stocks but also bonds and other assets as well. They are designed to work together and balance each other out so that you won’t experience the wild ride that other investors experience. We custom-design every portfolio with your specific time horizon and investment goals in mind, so you have the opportunity to achieve your goals regardless of what the markets do today or tomorrow.

4. Talk To A Professional About Risk

This is not the time to go it alone. It’s extremely beneficial to talk with someone who has been through these situations before and can help answer concerns specific to your needs and phase of life.

Depending on your age and financial circumstances, you might not feel like you have as much time to let the market bounce back. This is why it is even more crucial to make sure the types of investments you have align with your risk tolerance and time horizon. Are you ready to see all your options for protecting your money and build a foundation that can lead to success in any market? We at Balboa Wealth Partners are here for you. Give me a call at 949-445-1465 or email me at [email protected] to schedule an appointment.

About Jeff

Jeff Gilbert is the founder and CEO of Balboa Wealth Partners, a holistic financial management firm dedicated to providing clients guidance today for tomorrow’s success. With nearly three decades of industry experience, he has worked as both an advisor and executive-level manager, partnering with and serving a diverse range of clients. Specializing in serving high- and ultra-high-net-worth families, Jeff aims to help clients achieve their short-term and long-term goals, worry less about their finances, and focus more on their life’s passions. Based in Orange County, Jeff works with clients throughout Southern California as well as Arizona, Oregon, and Washington. To learn more, connect with Jeff on LinkedIn or email [email protected].

Advisory services provided by Balboa Wealth Partners, Inc., an Investment Advisor registered with the SEC. Advisory services are only offered to clients or prospective clients where Balboa Wealth Partners and its Investment Advisor Representatives are properly licensed or exempt from registration.

Securities offered through Chalice Capital Partners, LLC, member FINRA, SIPC.

Balboa offers advisory services independent of Chalice. Neither firm is affiliated.

____________

(1) https://www.nytimes.com/2020/01/01/business/wall-street-markets-2020.html

(2) http://www.moneychimp.com/features/market_cagr.htm

(3) https://www.macrotrends.net/1319/dow-jones-100-year-historical-chart