The Best Time to Invest Was Yesterday: Timing the Market

By Jeff Gilbert

It’s an all-too common theme: When economic news is bad, the stock market takes a hit as investors sell.

And there are many investors out there trying to buy low, hoping the market will rebound so they can sell for a profit.

But are either of these strategies sound? Should you even attempt to move your investments around based on economic factors or timing the market?

Let’s learn more about marketing timing and alternative investment planning strategies.

Market Timing Is Consistently Inconsistent

Timing the market usually involves attempting to “buy low and sell high” by analyzing current market trends for inefficiencies or volatility indicators. This strategy may work sometimes, but it is far from perfect. Not only do you have to guess when to buy in, but you then have to guess when to sell. That means for every gain, you have to be right twice to make timing the market worth it. Unfortunately, market bottoms can only be truly spotted in hindsight, and timing the market is often closer to playing the lottery than it is to an educated guess.

Timing the Market Is Expensive

Timing the market can also be expensive. Depending on your account type, asset class, and where you are executing your trades, you will likely be charged for every purchase and sale you make, and that’s on top of any taxes owed on gains. The more frequently you trade, the higher your transaction costs will be.

If you held the assets for less than a year, your gain will be taxed as ordinary income at your marginal tax rate, which can be as high as 37% for high-income earners. Long-term gains are taxed at a preferential rate. Regardless of your tax rate, your market timing must still be right more often than not just to cover the cost of your guess.

You Will Miss Out on Compound Growth & Market Rebounds

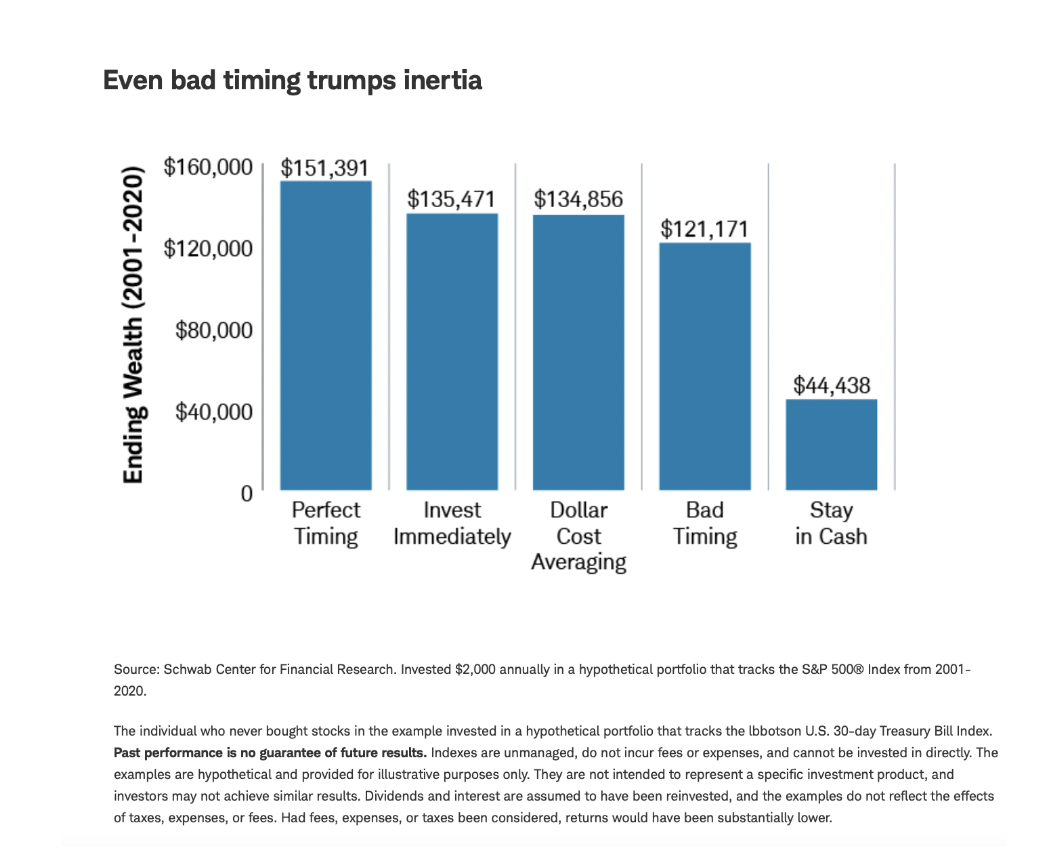

A recent study by Schwab Center for Financial Research found that bad market timing is worse than investing immediately, regardless of the market conditions at the time of investing. This indicates that even in market downturns, or just before a downturn, investors who invest immediately and remain invested will be better off than those who stay on the sidelines or attempt to time the market.

Take a look at Schwab’s graph below, which shows just how much more a fully invested portfolio earns over the course of 19 years. It would earn approximately $14,000 more in growth than a portfolio with bad market timing, and $91,000 more than a portfolio that stays in cash. The only investor who performs better is the one with perfect timing—but since we already know that perfect timing is impossible, investing immediately is the next best strategy.

What’s more, over time that extra $14,000 or $91,000 will have the opportunity to grow even more thanks to compounded interest. Even if the market fluctuates in the short term, the odds are high that a solid investment strategy will grow over time.

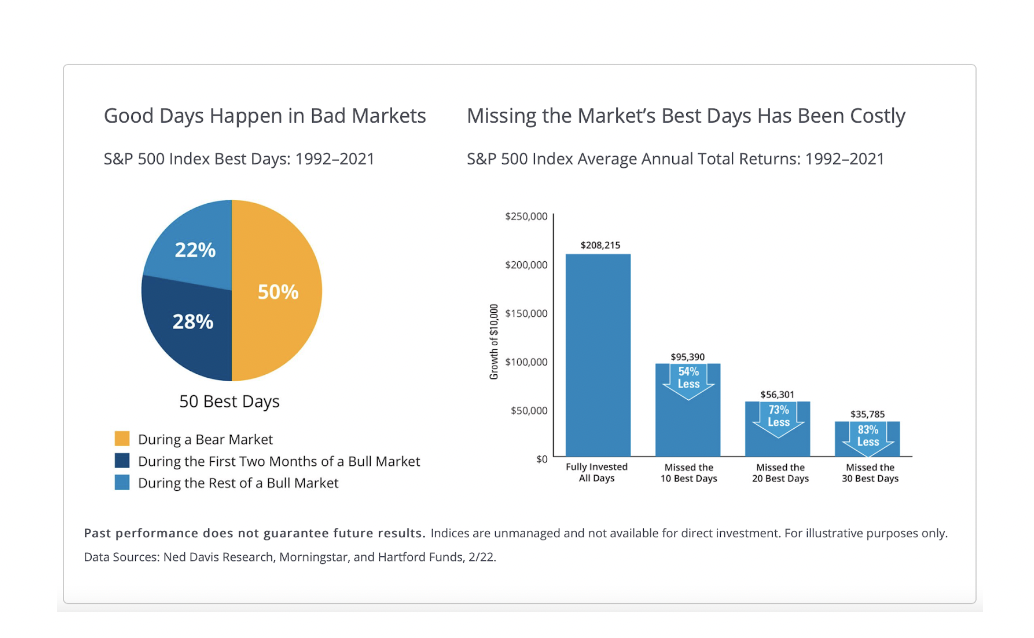

Another graph by Hartford Funds and Morningstar shows what happens if you miss the best days in the market, which often closely follow a major downturn and can be just as difficult to predict. An investor who missed the 10 best days in the market between 1992 and 2021 would have earned 54% less than someone who was fully invested during the same time period.

Someone who missed the 30 best market days would have earned a whopping $172,000 (83%) less than their fully invested counterpart. The research is based on a $10,000 initial investment, but these numbers would be much more dramatic if you were dealing with a $100,000 or even a $1,000,000 portfolio.

The time value of money tells us that a dollar today is worth more than a dollar tomorrow, and this is certainly the case when it comes to investing. The longer you are invested, the more likely you are to ride out the day-to-day market fluctuations and experience growth instead.

Are You Missing Out on Opportunities for Growth?

Remember, successful investing isn’t about market timing, it’s about time in the market. Consistent investing can help you realize the benefit of long-term growth, and working with a financial advisor empowers you to make informed, steady investments. That’s where Balboa Wealth Partners comes in!

If you want to speak about your investment planning strategy, give me a call at 949-445-1465 or email me at [email protected].

About Jeff

Jeff Gilbert is the founder and CEO of Balboa Wealth Partners, a holistic financial management firm dedicated to providing clients guidance today for tomorrow’s success. With over three decades of industry experience, he has worked as both an advisor and executive-level manager, partnering with and serving a diverse range of clients. Specializing in serving high- and ultra-high-net-worth families, Jeff aims to help clients achieve their short-term and long-term goals, worry less about their finances, and focus more on their life’s passions. Based in Orange County, Jeff works with clients throughout the entire country. To learn more, connect with Jeff on LinkedIn or email [email protected].

Advisory services provided by Balboa Wealth Partners, Inc., an Investment Advisor registered with the SEC. Advisory services are only offered to clients or prospective clients where Balboa Wealth Partners and its Investment Advisor Representatives are properly licensed or exempt from registration.

Securities offered through Kingswood Capital Partners, LLC, member FINRA, SIPC.

Balboa offers advisory services independent of Kingswood. Neither firm is affiliated.