By Jeff Gilbert

As everyone knows, 2020 has not been a normal year by any stretch of the imagination. The world as we know it has been turned upside down by five letters and a number: COVID-19. While the coronavirus pandemic is at its core a health issue, it has been the cause of many other issues, perhaps the greatest being economic. Today we’ll take a look at what is going on in the economy, most of which can trace its roots back to COVID-19.

Stock Market

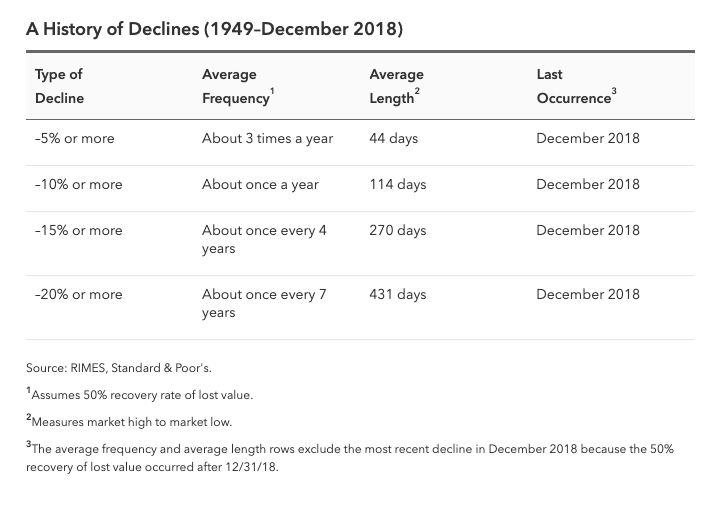

The year started off strong, with the S&P 500 reaching all-time highs and peaking on February 19. Then it all fell apart. In a little over a month, the index fell 34%, bottoming out on March 23. It’s been a bumpy ride, but the market has climbed out of the hole it was in and gained back 36% (as of May 27) from that low. (1)

Now, it may seem as if the S&P 500 has made up for all of its losses if it lost 34% and then gained back 36%. However, that is not the case because each percentage is based on its relative high or low. The index peaked at 3,386.15 points before falling 34% to 2,237.40. That loss was 1,148.75 points. Growth of 36% from the low point only accounts for 798.73 points, which means that the index overall is still down 10% from February’s high.

In addition to stock prices improving, volatility is calming down as well. In mid-March, things were swinging around so fiercely that the S&P 500 achieved double-digit movement in single days. Things have calmed down a lot since then, but volatility is still higher than it was pre-crisis. Things just seem calm now compared to the craziness of what has been called the longest March ever. (2)

Unemployment

Perhaps the area that has been impacted the most by the COVID-19 containment efforts is employment. It’s hard to keep a job when companies are being shut down and people aren’t allowed out of their homes. Weekly new unemployment claims have shattered all previous records by multiples. The official unemployment rate for April is 14.7%, though estimates put it closer to 20% due to some data-collection errors. (3) There are now approximately 25 million Americans receiving unemployment benefits (4) on top of millions who have seen hours and wages cut and business revenues fall.

Federal Reserve & Government Intervention

The Federal Reserve stepped up early on in the pandemic to slash rates to near zero. It has also worked hard to provide financing for businesses trying to stay afloat in these turbulent waters.

Congress has passed a number of bills to aid both individuals and organizations, the largest being the $2 trillion CARES Act, which was signed into law on March 27. The Act provided individual stimulus checks, enhanced unemployment benefits, and loan programs to help businesses. Despite extreme actions taken by both the Federal Reserve and the federal government, some economists still say that they will need to do more before meaningful recovery will take place. (5)

Economy

As the country eases out of lockdown and restrictions are being loosened, there has been an uptick in economic activity, though not enough to stop the economy from contracting. The leisure and hospitality industries have been devastated (6) while the service sector is still struggling under social distancing guidelines. (7) Factory activity is still down and agricultural conditions are deteriorating. (8) Overall, pessimism reigns supreme over the economy even while some Federal Reserve policymakers believe we are either at or near the bottom and are expecting a rebound in the second half of the year. (9) The global economy is continuing to decline, but at a slower pace than it did in April, (10) which seems to confirm their predictions.

As you can see, this year has been anything but normal so far and there are more than likely going to be even more plot twists as we enter the summer and fall. While the global economy seems to be gasping for breath, it is not the end of the world. We may have some hard months and years ahead of us, but it isn’t the first time our nation has faced challenges like this.

We’re Here For You

While our economic woes may not be new for history, they very well could be new for you. In difficult times like these, it is helpful to have a trusted advisor that you can turn to for financial guidance and support. If you don’t want to go through this economic crisis alone, our team at Balboa Wealth Partners is here for you. Give me a call at 949-445-1465 or email me at jgilbert@balboawealth.com so we can have a no-obligation conversation about where you are and how we may be able to help.

About Jeff

Jeff Gilbert is the founder and CEO of Balboa Wealth Partners, a holistic financial management firm dedicated to providing clients guidance today for tomorrow’s success. With nearly three decades of industry experience, he has worked as both an advisor and executive-level manager, partnering with and serving a diverse range of clients. Specializing in serving high- and ultra-high-net-worth families, Jeff aims to help clients achieve their short-term and long-term goals, worry less about their finances, and focus more on their life’s passions. Based in Orange County, Jeff works with clients throughout Southern California as well as Arizona, Oregon, and Washington. To learn more, connect with Jeff on LinkedIn or email jgilbert@balboawealth.com.

Advisory services provided by Balboa Wealth Partners, Inc., an Investment Advisor registered with the SEC. Advisory services are only offered to clients or prospective clients where Balboa Wealth Partners and its Investment Advisor Representatives are properly licensed or exempt from registration.

Securities offered through Chalice Capital Partners, LLC, member FINRA, SIPC.

Balboa offers advisory services independent of Chalice. Neither firm is affiliated.

____________