As global markets continue their roller coaster ride due to fears surrounding the coronavirus, our most recent bull market officially turned into a bear market. But what does that mean? And are we on the verge of another recession like the one we had in 2008?

In light of all these concerns, today we’ll share what you need to know about recessions and bear markets. If you are worried about your portfolio, we understand and we’re here to help. Feel free to contact our office to get answers to your specific questions.

What Is A Bear Market?

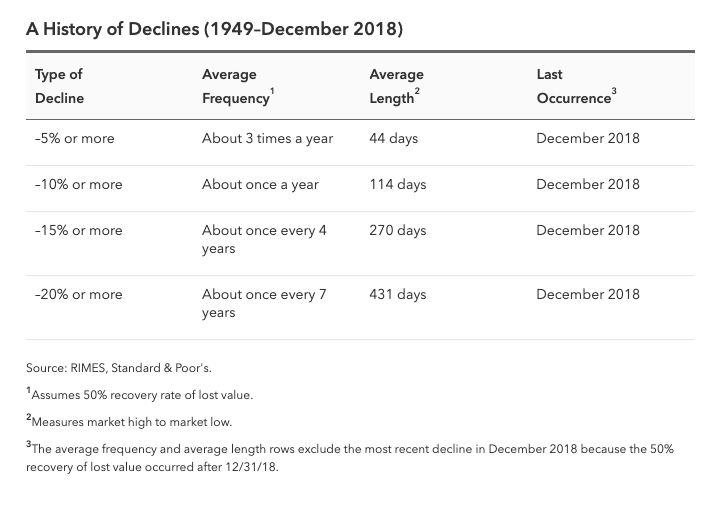

A bear market happens when an overall market benchmark, such as the S&P 500, dips by 20% or more from its most recent high. (1) This is often accompanied by negative investor sentiment and more selling than buying.

It’s important to highlight that normal stock market volatility isn’t an indicator of a bear market. Normal dips and swings are necessary for long-term growth and shouldn’t be cause for concern.

What Is A Recession?

A recession is defined as two consecutive quarters of economic decline (emphasis on the word economic). They’re measured using factors such as the employment rate, gross domestic product, bond yield curves, and other factors independent of the stock market. (2)

Economists declare recessions retroactively. For example, the Great Recession wasn’t confirmed until November 2008—11 months after it started. (3)

Bear Markets Vs. Recessions: How Are They Related?

A bear market relates to the stock market. A recession relates to the economy. Contrary to popular belief, the stock market is not the economy. What drives the stock market is investor emotions—which, as we all know, can be fickle. As humans, we have a tendency to be overly optimistic when there’s no data to support our feelings, and pessimistic when data looks great.

Recessions are the complete opposite. Tangible factors determine the state of our economy. There’s no emotion involved. Which begs the question: Why do people correlate recessions and bear markets?

If you look back on history, recessions and bear markets have usually occurred around the same time. Of the last 11 S&P 500 bear markets we’ve had since 1957, 63.6% came after a recession. (4) The two go hand in hand, but they’re not the same.

Not even highly educated economists can predict a bear market or recession. There’s a lot of speculation that goes on in the news, but it’s just that—speculation.

What Should Investors Do?

The best thing to do as a long-term investor is to find an optimal portfolio that balances your comfortable level of risk and return. The actions you take in the stock market should be independent of whether economists think we’re entering a bear market or recession.

And as many financial experts have advised: Your 401(k) right now is like your face: Don’t touch it. Selling due to fear when the market is down locks in your losses and can do long-term damage to your financial future.

Speak With Your Advisor

Whether you’re new to investing or an experienced investor, it’s helpful to consult with an objective third party during times like this. Human nature causes us all to act out of emotion when our accounts go down. As an independent firm, we put your best interests first. We seek to serve as a support system for our clients, helping them make informed financial decisions that are not driven by emotion.

We’re Here For Your Friends And Family

If you have friends or family who need help with their investments, we are happy to offer a complimentary portfolio review and recommendations. We can discuss what is appropriate for their immediate needs and long-term objectives. Sometimes simply speaking with a financial advisor may help investors feel more confident and less concerned with the most recent market activity.

About Jeff

Jeff Gilbert is the founder and CEO of Balboa Wealth Partners, a holistic financial management firm dedicated to providing clients guidance today for tomorrow’s success. With nearly three decades of industry experience, he has worked as both an advisor and executive-level manager, partnering with and serving a diverse range of clients. Specializing in serving high- and ultra-high-net-worth families, Jeff aims to help clients achieve their short-term and long-term goals, worry less about their finances, and focus more on their life’s passions. Based in Orange County, Jeff works with clients throughout Southern California as well as Arizona, Oregon, and Washington. To learn more, connect with Jeff on LinkedIn or email jgilbert@balboawealth.com.

Advisory services provided by Balboa Wealth Partners, Inc., an Investment Advisor registered with the SEC. Advisory services are only offered to clients or prospective clients where Balboa Wealth Partners and its Investment Advisor Representatives are properly licensed or exempt from registration.

Securities offered through Chalice Capital Partners, LLC, member FINRA, SIPC.

Balboa offers advisory services independent of Chalice. Neither firm is affiliated.

___________

(1) https://www.investopedia.

(3) https://www.usatoday.com/