https://balboawealth.com/wp-content/uploads/2023/03/2023-3_leave-a-lasting-legacy.jpeg

384

768

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2023-03-01 16:16:172023-11-16 13:53:12Leave a Lasting Legacy: What Inheritance Are You Passing On to Your Kids?

https://balboawealth.com/wp-content/uploads/2023/03/2023-3_leave-a-lasting-legacy.jpeg

384

768

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2023-03-01 16:16:172023-11-16 13:53:12Leave a Lasting Legacy: What Inheritance Are You Passing On to Your Kids? https://balboawealth.com/wp-content/uploads/2023/03/2023-3_leave-a-lasting-legacy.jpeg

384

768

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2023-03-01 16:16:172023-11-16 13:53:12Leave a Lasting Legacy: What Inheritance Are You Passing On to Your Kids?

https://balboawealth.com/wp-content/uploads/2023/03/2023-3_leave-a-lasting-legacy.jpeg

384

768

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2023-03-01 16:16:172023-11-16 13:53:12Leave a Lasting Legacy: What Inheritance Are You Passing On to Your Kids?

5 Investment Trends to Watch in 2023

By Jeff Gilbert

With all the market volatility, rising interest rates, and persistent inflation we saw in 2022, many investors are wondering what they should expect from the markets in 2023 (and beyond). While we can’t predict exactly what…

Don’t Let 2023 Catch You Unprepared: Review Your Financial Plan

By Jeff Gilbert

Every new year brings with it renewed energy and commitments to improve—not just yourself, but improving your finances, strengthening your savings, and planning for the future. At Balboa Wealth Partners, we believe that…

Balboa Wealth Partners Wishes You Happy Holidays!

Balboa Wealth Partners wishes you a happy holiday season. We hope this holiday season brings you joy.

Your End-of-the-Year Checklist for Small Business Owners

By Jeff Gilbert

It’s hard to believe that another tax season is just around the corner, but 2022 is almost at an end. With a lot of the pandemic-era programs petering out, it’s important to know what lies ahead to be prepared for what’s…

3 Tips to Make Your Money Last a Lifetime

Excited about your retirement bucket list? Don’t let worry about running out of money spoil your dream retirement. Check out these 3 tips!

Retirement Commentary

Investment Updates

https://balboawealth.com/wp-content/uploads/2021/04/balboa-pier-2-home-page-scaled.jpg

1707

2560

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2024-12-10 10:16:212024-12-10 10:16:21BWP Weekly Market Commentary

https://balboawealth.com/wp-content/uploads/2021/04/balboa-pier-2-home-page-scaled.jpg

1707

2560

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

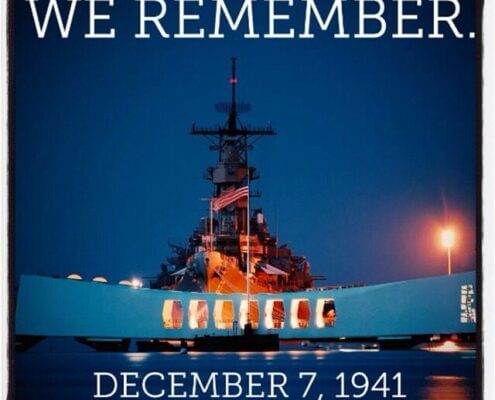

Jeff Gilbert2024-12-10 10:16:212024-12-10 10:16:21BWP Weekly Market Commentary https://balboawealth.com/wp-content/uploads/2020/12/Pearl-harbor-memorial.jpg

640

640

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2024-12-03 07:50:122024-12-03 07:50:12BWP Weekly Market Commentary

https://balboawealth.com/wp-content/uploads/2020/12/Pearl-harbor-memorial.jpg

640

640

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2024-12-03 07:50:122024-12-03 07:50:12BWP Weekly Market Commentary https://balboawealth.com/wp-content/uploads/2019/11/happy-thanksgiving.jpg

344

550

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2024-11-26 09:08:082024-11-26 09:08:08BWP Weekly Market Commentary

https://balboawealth.com/wp-content/uploads/2019/11/happy-thanksgiving.jpg

344

550

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2024-11-26 09:08:082024-11-26 09:08:08BWP Weekly Market Commentary https://balboawealth.com/wp-content/uploads/2023/12/qtq80-rY62im.jpeg

836

1255

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2024-11-24 13:51:502024-11-24 13:51:50BWP Weekly Market Commentary

https://balboawealth.com/wp-content/uploads/2023/12/qtq80-rY62im.jpeg

836

1255

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2024-11-24 13:51:502024-11-24 13:51:50BWP Weekly Market Commentary https://balboawealth.com/wp-content/uploads/2024/11/veterans-day.jpg

168

300

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2024-11-12 08:15:012024-11-12 13:25:34BWP Weekly Market Commentary

https://balboawealth.com/wp-content/uploads/2024/11/veterans-day.jpg

168

300

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2024-11-12 08:15:012024-11-12 13:25:34BWP Weekly Market Commentary https://balboawealth.com/wp-content/uploads/2024/11/election-24.jpg

175

288

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2024-11-05 08:03:442024-11-05 08:03:44BWP Weekly Market Commentary

https://balboawealth.com/wp-content/uploads/2024/11/election-24.jpg

175

288

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2024-11-05 08:03:442024-11-05 08:03:44BWP Weekly Market CommentaryBalboa Platform

General

4 Steps to Take Toward Your Dream Retirement

Don’t let the present moment pass you by as you work toward retirement. Here are 4 ways to start living your retirement dream now!

Financial Planning for Aging Parents

Caring for an aging parent can be overwhelming. Here are 5 strategies to prepare financially for elderly parents.

How I Invest My Own Money

Successful money management and investing techniques don’t have to be shrouded in mystery. Here’s how I invest my own money!

What Is a Fee-Only Financial Advisor and Why Does it Matter?

Looking for a financial advisor? Here is why you should choose a fee-only financial advisor.

The Cost of Putting Off Financial Planning

By Jeff Gilbert

With everything on your overflowing plate, organizing your finances probably keeps getting put on the back burner. We get it. Whether it be insurance planning, filing taxes, or putting together an estate plan, most people…

Top 6 Habits of Financially Successful People

By Jeff Gilbert

Defining financial success is a hard thing to do. Some people consider financial success to be a feeling of reassurance and safety, while others consider financial success to be a symbol of status and power. However you choose…

Balboa Wealth Partners

Newport Beach, CA Office

130 Newport Center Drive, Ste. 240

Newport Beach, CA 92660

Scottsdale, AZ Office

6263 N. Scottsdale Road, Ste. 265

Scottsdale, AZ 85250

Disclosures

Balboa Wealth Partners, INC. is an SEC-registered investment advisor. Advisory services are only offered to clients or prospective clients where Balboa Wealth Partners, and its representatives are properly licensed or exempt from licensure.