https://balboawealth.com/wp-content/uploads/2020/03/Could-a-donor.jpg

512

1024

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2020-03-02 17:27:282020-03-02 17:29:34Can A Donor-Advised Fund Save You Money On Taxes?

https://balboawealth.com/wp-content/uploads/2020/03/Could-a-donor.jpg

512

1024

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2020-03-02 17:27:282020-03-02 17:29:34Can A Donor-Advised Fund Save You Money On Taxes? https://balboawealth.com/wp-content/uploads/2020/03/Could-a-donor.jpg

512

1024

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2020-03-02 17:27:282020-03-02 17:29:34Can A Donor-Advised Fund Save You Money On Taxes?

https://balboawealth.com/wp-content/uploads/2020/03/Could-a-donor.jpg

512

1024

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2020-03-02 17:27:282020-03-02 17:29:34Can A Donor-Advised Fund Save You Money On Taxes?

What Should You Do About The Coronavirus And Stock Market Volatility?

The financial markets took a big dip early this week over fears about the spreading coronavirus, erasing gains from earlier this year. After the Dow lost over 800 points on Tuesday, it was down a total of 1,900 points in two days.

Investors…

5 Ways To Prepare For A More Affordable Retirement

By Jeff Gilbert

Retirement is expensive. That’s one thing everyone can agree on. But what if there were steps you could take now to actively reduce the amount of money you’ll need later on? That’s exactly what we’ll talk about today.…

How Might The Market Behave In 2020?

By Jeff Gilbert

This January, we find ourselves in a much different place than we did a year ago. Last year came on the heels of a difficult December, where the market dropped precipitously over recession worries. Then the market surprised…

Are You Ready For A New Year? 5 Steps To Take Before You Say Hello To 2020

By Jeff Gilbert

This year (and decade!) is quickly coming to a close, and if you’re like most Americans, you spend the month of December neck-deep in Christmas parties, shopping for gifts, and planning for travel. You might think that managing…

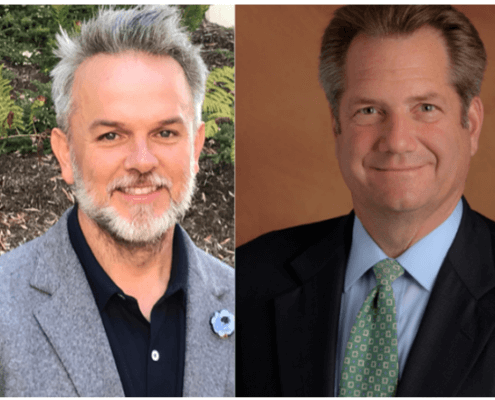

Welcome Our New Team Members!

By Jeff Gilbert

Balboa Wealth Partners is thrilled to welcome two new additions to our team, Aarone Tirpak and Mark Zielinski! We love that our firm is growing and expanding, and we are thankful to have these two extraordinary advisors here…

Retirement Commentary

Investment Updates

https://balboawealth.com/wp-content/uploads/2023/08/qtq80-Ih83pL.jpeg

836

1254

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2024-03-19 08:33:312024-03-19 08:33:31BWP Weekly Market Commentary

https://balboawealth.com/wp-content/uploads/2023/08/qtq80-Ih83pL.jpeg

836

1254

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2024-03-19 08:33:312024-03-19 08:33:31BWP Weekly Market Commentary https://balboawealth.com/wp-content/uploads/2015/10/iStock-626901080-5.jpg

1900

1900

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2024-03-17 09:55:292024-03-17 09:55:29BWP Weekly Market Commentary

https://balboawealth.com/wp-content/uploads/2015/10/iStock-626901080-5.jpg

1900

1900

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2024-03-17 09:55:292024-03-17 09:55:29BWP Weekly Market Commentary https://balboawealth.com/wp-content/uploads/2024/03/qtq80-fgytsA.jpeg

1440

2160

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2024-03-05 09:52:532024-03-05 09:52:53BWP Weekly Market Commentary

https://balboawealth.com/wp-content/uploads/2024/03/qtq80-fgytsA.jpeg

1440

2160

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2024-03-05 09:52:532024-03-05 09:52:53BWP Weekly Market Commentary https://balboawealth.com/wp-content/uploads/2018/12/StockMarket.png

512

1024

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2024-02-27 09:49:152024-02-27 09:49:15BWP Weekly Market Commentary

https://balboawealth.com/wp-content/uploads/2018/12/StockMarket.png

512

1024

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2024-02-27 09:49:152024-02-27 09:49:15BWP Weekly Market Commentary https://balboawealth.com/wp-content/uploads/2022/02/Whats-Going-on-With-Inflation_-3-Reasons-Why-Its-Here-to-Stay.jpeg

397

599

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2024-02-20 07:58:262024-02-20 07:58:26BWP Weekly Market Commentary

https://balboawealth.com/wp-content/uploads/2022/02/Whats-Going-on-With-Inflation_-3-Reasons-Why-Its-Here-to-Stay.jpeg

397

599

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2024-02-20 07:58:262024-02-20 07:58:26BWP Weekly Market Commentary

BWP Weekly Market Commentary

https://vimeo.com/912612725

Balboa Platform

General

Why I Love Living And Working In Newport Beach

Newport Beach is a gorgeous coastal city in Orange County, California. And let me tell you, it’s an absolute paradise—a paradise I’m lucky enough to call home. I can honestly say there are few places on this earth where I’d rather live.…

Jump-Start Your Financial Plan For 2019!

What new goals are you trying to reach in 2019? Are you focusing on your physical health by joining a gym and cleaning up your diet? Are you throwing yourself into your career in order to earn a promotion? Or maybe, like millions of other people,…

Balboa Wealth Partners Welcomes Two Advisors!

Balboa Wealth Partners is growing! Not only are we passionate about offering the highest level of service to each and every client that comes our way, but we continually stretch ourselves and grow in our knowledge and experience. We believe…

What We Are Thankful For In 2018

Happy Thanksgiving from our team at Balboa Wealth Partners! We want to take a moment to thank you for being a part of our family. We sincerely appreciate the trust you place in our firm and we take our responsibility to you and your family very…

5 Unexpected Threats To Your Retirement Plan

There’s no doubt that there are plenty of things that could threaten your financial success. A personal tragedy could cost you everything you have, a natural disaster could destroy your home, and a recession could diminish your nest egg. While…

How To Teach Your Kids About Money

Becoming a parent is a life-changing event, and there are numerous things we want to teach our children to become independent and successful adults. As a society, we are excelling in some areas of parenting, but falling behind in others. In…

Balboa Wealth Partners

Newport Beach, CA Office

130 Newport Center Drive, Ste. 240

Newport Beach, CA 92660

Scottsdale, AZ Office

6263 N. Scottsdale Road, Ste. 265

Scottsdale, AZ 85250

Disclosures

Balboa Wealth Partners, INC. is an SEC-registered investment advisor. Advisory services are only offered to clients or prospective clients where Balboa Wealth Partners, and its representatives are properly licensed or exempt from licensure.