https://balboawealth.com/wp-content/uploads/2025/06/2025-6_The-One-Big-Beautiful-Tax-Cut-Act-What-You-Need-to-Know-CANVA.jpg

900

1600

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2025-06-03 12:53:562025-06-03 12:54:25The One Big Beautiful Tax Cut Act: What You Need to Know

https://balboawealth.com/wp-content/uploads/2025/06/2025-6_The-One-Big-Beautiful-Tax-Cut-Act-What-You-Need-to-Know-CANVA.jpg

900

1600

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2025-06-03 12:53:562025-06-03 12:54:25The One Big Beautiful Tax Cut Act: What You Need to Know https://balboawealth.com/wp-content/uploads/2025/06/2025-6_The-One-Big-Beautiful-Tax-Cut-Act-What-You-Need-to-Know-CANVA.jpg

900

1600

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2025-06-03 12:53:562025-06-03 12:54:25The One Big Beautiful Tax Cut Act: What You Need to Know

https://balboawealth.com/wp-content/uploads/2025/06/2025-6_The-One-Big-Beautiful-Tax-Cut-Act-What-You-Need-to-Know-CANVA.jpg

900

1600

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2025-06-03 12:53:562025-06-03 12:54:25The One Big Beautiful Tax Cut Act: What You Need to Know

Navigating Market Volatility in Retirement

By Jeff Gilbert

Retirement is a much-anticipated milestone, but it comes with its own set of financial challenges. One of the biggest hurdles is managing the unpredictable nature of market volatility.

Despite the ups and downs of the market,…

If I Could Only Teach Two Financial Lessons

By Jeff Gilbert

Financial literacy is one of the most essential life skills, yet it’s rarely taught in schools. That means the responsibility falls on parents to equip their kids with the knowledge they need to make smart money decisions.…

2025’s Best Tax Deductions for Small Businesses & Startups

By Jeff Gilbert

As a small business or startup owner, preserving more of your profits is essential to support your family or reinvest back in your business. Taking advantage of tax deductions for small businesses in 2025 can reduce your income…

Take Financial Charge in 2025: Tips for Affluent Families

By Jeff Gilbert

Affluent families face a distinct set of financial planning opportunities and challenges in 2025. It takes a proactive and strategic approach to navigate complex markets, changing tax rules, and the ever-increasing demands…

Wishing You Happy Holidays From Our Team!

By Jeff Gilbert

Season’s Greetings from all of us at Balboa Wealth Partners! This year has been filled with its share of challenges and triumphs, and through it all, we’ve been honored to serve clients like you. Your trust means the world…

Retirement Commentary

https://balboawealth.com/wp-content/uploads/2025/06/Screenshot-2025-06-05-103542.png

653

1232

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2025-06-05 10:33:272025-06-05 10:37:04Retire at 60 with Josh Bliss

https://balboawealth.com/wp-content/uploads/2025/06/Screenshot-2025-06-05-103542.png

653

1232

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2025-06-05 10:33:272025-06-05 10:37:04Retire at 60 with Josh Bliss

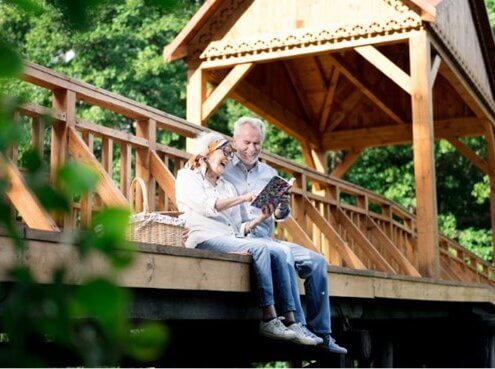

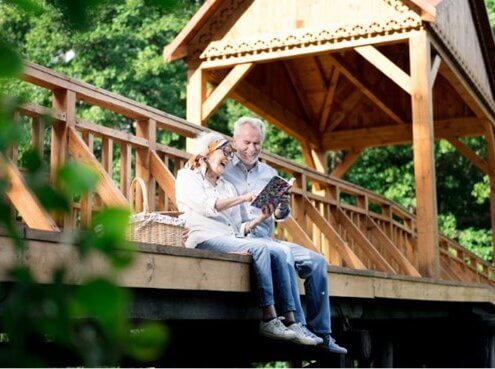

Will Your Nest Egg Last? Assess Your Retirement Savings Target

Will your nest egg stand the test of time? Take a closer look at your retirement savings target and stay on track for your financial future.

From Start to Finish: Understanding the Different Phases of Retirement Planning

By Jeff Gilbert

Retirement might feel like something far off in the future that you don’t need to think about yet. You can plan for it, save up for it, and even daydream about it, but we often overlook the nuances and details of each retirement…

Retiring Comfortably: Determining Your Retirement Savings Target

By Jeff Gilbert

How much cash do you need in order to kick back in retirement? The experts throw around figures like 55-80% of your pre-retirement income, but is that the full story?

Spoiler alert: it’s not. Your dream retirement is…

Common Retirement Mistakes and How to Avoid Them

By Jeff Gilbert

Making mistakes is an inevitable part of being human, and we often use past mistakes as a way to learn and make better decisions in the future. However, in retirement, there is far less room for error. Making such a significant…

Leave a Lasting Legacy: What Inheritance Are You Passing On to Your Kids?

By Jeff Gilbert

When we think about the legacy we want to leave for our children, it goes beyond just money. We want to make sure our gift to them provides stability for many years. We don’t want to pass on a jumble of assets, debts, and…

Investment Updates

https://balboawealth.com/wp-content/uploads/2025/06/qtq80-kSsvrX.jpeg

866

1212

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2025-06-17 08:55:172025-06-17 08:55:17BWP Weekly Market Commentary

https://balboawealth.com/wp-content/uploads/2025/06/qtq80-kSsvrX.jpeg

866

1212

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2025-06-17 08:55:172025-06-17 08:55:17BWP Weekly Market Commentary https://balboawealth.com/wp-content/uploads/2017/03/gallery-6.jpg

1280

1920

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2025-06-10 09:24:252025-06-10 09:24:25BWP Weekly Market Commentary

https://balboawealth.com/wp-content/uploads/2017/03/gallery-6.jpg

1280

1920

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2025-06-10 09:24:252025-06-10 09:24:25BWP Weekly Market Commentary https://balboawealth.com/wp-content/uploads/2018/12/StockMarket.png

512

1024

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2025-06-03 10:10:562025-06-03 10:10:56BWP Weekly Market Commentary

https://balboawealth.com/wp-content/uploads/2018/12/StockMarket.png

512

1024

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2025-06-03 10:10:562025-06-03 10:10:56BWP Weekly Market Commentary https://balboawealth.com/wp-content/uploads/2017/09/why-i-became-1.jpg

512

1024

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2025-05-28 08:45:422025-05-28 08:45:42BWP Weekly Market Commentary

https://balboawealth.com/wp-content/uploads/2017/09/why-i-became-1.jpg

512

1024

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2025-05-28 08:45:422025-05-28 08:45:42BWP Weekly Market Commentary https://balboawealth.com/wp-content/uploads/2025/05/f06d1d_ce38308f02ec4c96aeddbc9bfb08d36cmv2.avif

378

568

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2025-05-20 08:51:592025-05-20 08:51:59BWP Weekly Market Commentary

https://balboawealth.com/wp-content/uploads/2025/05/f06d1d_ce38308f02ec4c96aeddbc9bfb08d36cmv2.avif

378

568

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2025-05-20 08:51:592025-05-20 08:51:59BWP Weekly Market Commentary https://balboawealth.com/wp-content/uploads/2024/10/2024-10_Why-Its-Important-to-Have-a-Fiduciary-Financial-Advisor.jpg

512

1024

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2025-05-13 16:53:262025-05-13 16:53:26BWP Weekly Market Commentary

https://balboawealth.com/wp-content/uploads/2024/10/2024-10_Why-Its-Important-to-Have-a-Fiduciary-Financial-Advisor.jpg

512

1024

Jeff Gilbert

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Jeff Gilbert2025-05-13 16:53:262025-05-13 16:53:26BWP Weekly Market CommentaryBalboa Platform

A Holistic, Relationship Based Approach To Wealth Management | WriteForMe & Balboa Wealth Partners

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

0

0

Vanessa Turner

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Vanessa Turner2025-01-03 10:35:572025-02-14 10:56:46Form CRS

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

0

0

Vanessa Turner

https://balboawealth.com/wp-content/uploads/2023/10/balboa-white-1.png

Vanessa Turner2025-01-03 10:35:572025-02-14 10:56:46Form CRS

Announcing Our Second Office Location!

After years of serving our loyal clients out of our California office, we are excited to announce that we have opened a second location in Scottsdale, Arizona. As our firm continues to grow, we want to be able to expand our offering and build…

How Does An Independent Financial Advisor Benefit You?

As a holistic financial management firm, we pride ourselves in offering the very best to our clients when developing a wealth management plan that works for each individual and their families. We can offer great guidance based on our clients’…

Happy Holidays From Balboa Wealth Partners

By Jeff Gilbert

It’s been a wild ride, but we have finally arrived at the holidays. Our team at Balboa Wealth Partners would like to take this opportunity to wish you and yours a happy holiday and a refreshing new year! The holiday season,…

Why I am Passionate About Being a Financial Advisor

By Jeff Gilbert

So many people find themselves stuck in a career they aren’t passionate about or enjoy. In fact, two-thirds of people are disengaged with their job. I feel incredibly fortunate that I have a career I love and that I look…

General

A Holistic, Relationship Based Approach To Wealth Management | WriteForMe & Balboa Wealth Partners

Navigating Stock Market Volatility

Navigating Stock Market Volatility

Market volatility can be unsettling, especially when it seems like every news headline is about sharp declines or dramatic rebounds. It’s important to provide some perspective on what market fluctuations…

Don’t Let Emotional Investing Control Your Wealth

By Jeff Gilbert

Emotions are strong influences in life. Our financial decisions can really tug at our heartstrings, and even when we try our best, it’s difficult to look at our finances without getting emotional.

Why? Our money habits…

Our Midyear 2024 Market Update

By Jeff Gilbert

Here we are, halfway through 2024 already—have you paused to take time for a financial check-in? How’s your money game going? Now is the perfect moment to slow down and notice the economic trends shaping our market and…

Retiring Comfortably: Determining Your Retirement Savings Target

By Jeff Gilbert

How much cash do you need in order to kick back in retirement? The experts throw around figures like 55-80% of your pre-retirement income, but is that the full story?

Spoiler alert: it’s not. Your dream retirement is…

Planning for the Long Haul: Addressing Inflation’s Impact on Your Financial Plan

By Jeff Gilbert

Inflation acts like erosion as it quietly eats away at the value of our money—often without us realizing it until many years down the road. You might only notice the effect it’s had on your day-to-day life when there’s…

Balboa Wealth Partners

Newport Beach, CA Office

1400 Newport Center Drive, Ste. 290

Newport Beach, CA 92660

Scottsdale, AZ Office

6263 N. Scottsdale Road, Ste. 265

Scottsdale, AZ 85250

Disclosures

Balboa Wealth Partners, INC. is an SEC-registered investment advisor. Advisory services are only offered to clients or prospective clients where Balboa Wealth Partners, and its representatives are properly licensed or exempt from licensure.