By Jeff Gilbert

Wisdom comes with age. We all know this, and we’ve all experienced the learning and growing that comes from making mistakes or forging our own path. But if you had the chance to go back in time and give your younger self some hard-won advice, what would you say?

As a financial advisor who helps countless people prepare for the future and set their finances up for success, my three pieces of advice center around managing money. Here’s what I wish I had known about money when I was younger.

Pay Yourself First

In practice, paying yourself first means depositing into your savings and investment accounts before you divvy up your paychecks amongst your living expenses and wants.

Wouldn’t you rather be your own bank when you are older? Money is simply a resource that gives us options. No money means no options. The ultimate goal is to accumulate enough wealth to live off of in complete financial freedom. Financial freedom is defined as having sufficient personal resources to live without needing to work to cover the basics. It means you have the time and money to pursue fulfillment in your life. If you have financial freedom, you can focus on living your life rather than making a living. But financial freedom doesn’t happen accidentally. Short of inheriting a windfall, financial freedom becomes a reality through patient and disciplined saving.

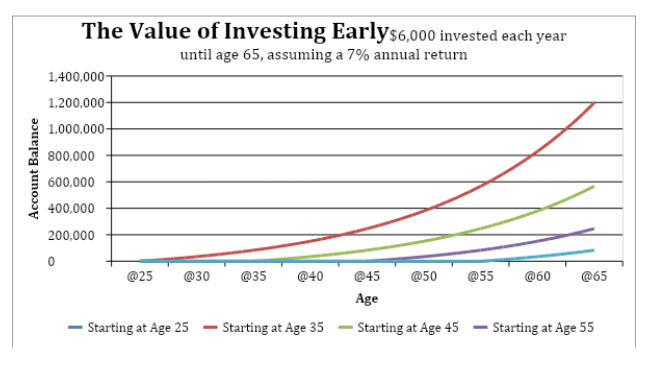

By investing and growing your portfolio at a young age, you increase your money’s potential for growth. That’s the power of compound interest—it helps the money you put away grow faster due to interest building upon itself. It means that not only do you earn interest on your principal, but on the interest you’ve already earned as well, so you are earning interest on interest. You can make your money work smarter rather than harder to pursue your goals.

Beginning to invest at age 25 and contributing regularly could result in more than doubling the value of your investments at age 65, compared to waiting to start at age 35.

Be Strategic With Your Savings

You’ve probably heard this before, but it’s a tried-and-true solution for wealth management that works every time. Start with a 401(k) if your employer offers a retirement plan, especially if an employer-matching contribution is offered since it is a guaranteed return on the funds contributed. You can also save a percentage of your monthly income in an investment account such as a traditional IRA or Roth IRA and/or a taxable investment account, depending on your situation, to minimize your tax liability either now or in the future.

The key is to be disciplined and consistent. Set up automatic contributions to tax-advantaged accounts and create an investment strategy that’s aligned with your goals.

Prioritize Education

Another way to be strategic with your savings is to take advantage of college savings accounts to prepare for the costs of higher education for your kids and grandchildren. With tuition costs climbing year after year, saving for higher education is incredibly important.

Enter the 529 plan. This type of educational savings plan is a qualified tuition plan created so that families can receive tax benefits for saving toward qualified higher-education expenses. After-tax money is invested in a 529 plan, where it grows tax-free. When the money is later taken out for qualified expenses, there are no federal taxes due. Over 30 states also offer a deduction or tax credit for contributions to a 529 plan. (1)

Just like saving for retirement, saving for college early and often will help you optimize compound interest and offset the cost of education.

Take the First Step

At Balboa Wealth Partners, we understand the impact that financial planning and good money habits can have on the wealth of an individual or family in the long run. If you’d like to learn more about how we can help, don’t hesitate to reach out to us for a complimentary meeting. To get started, contact my office by calling 949-445-1465 or email me at [email protected].

About Jeff

Jeff Gilbert is the founder and CEO of Balboa Wealth Partners, a holistic financial management firm dedicated to providing clients guidance today for tomorrow’s success. With nearly three decades of industry experience, he has worked as both an advisor and executive-level manager, partnering with and serving a diverse range of clients. Specializing in serving high- and ultra-high-net-worth families, Jeff aims to help clients achieve their short-term and long-term goals, worry less about their finances, and focus more on their life’s passions. Based in Orange County, Jeff works with clients throughout the entire country. To learn more, connect with Jeff on LinkedIn or email [email protected].

Advisory services provided by Balboa Wealth Partners, Inc., an Investment Advisor registered with the SEC. Advisory services are only offered to clients or prospective clients where Balboa Wealth Partners and its Investment Advisor Representatives are properly licensed or exempt from registration.

Securities offered through Chalice Capital Partners, LLC, member FINRA, SIPC.

Balboa offers advisory services independent of Chalice. Neither firm is affiliated.

___________

Balboa Wealth Partners

Newport Beach, CA Office

130 Newport Center Drive, Ste. 240

Newport Beach, CA 92660

Scottsdale, AZ Office

6263 N. Scottsdale Road, Ste. 265

Scottsdale, AZ 85250

Disclosures

Balboa Wealth Partners, INC. is an SEC-registered investment advisor. Advisory services are only offered to clients or prospective clients where Balboa Wealth Partners, and its representatives are properly licensed or exempt from licensure.