7 Rules Of Investing

By Jeff Gilbert

When it comes to finances, words like “saving” and “budgeting” can seem fairly self-explanatory. But how about the word “investing”? Now that sounds a bit more complicated. What does it take to succeed in investing? A set formula? A special skill and talent? Rather than being intimidated and overwhelmed, crossing your fingers, and hoping for the best, let’s conduct a quick crash course on the topic. The more you know, the more confident you’ll be.

Whether you choose to purchase stocks and bonds, contribute to a retirement account such as a 401(k), or even invest in real estate, there are time-tested principles to investing wisely, and following these 7 rules of investing will help put you on a path toward reaching your goals (hopefully without headaches).

1. Manage Your Emotions

Behavior is a major factor in investment success. By being aware of your emotions and knowing your behavioral pitfalls, you can avoid many potential investment mistakes caused by panic. Finances are an integral part of our lives and it’s difficult to separate them from our emotions, but your nest egg will thank you if you can learn to take your time when making decisions and stay strong and committed when the market feels like a roller coaster.

2. Stay Away From Predictions

Wouldn’t it be wonderful to have a crystal ball to predict where the markets will go or what the economy will do? Unfortunately, it’s not that simple. Don’t worry about what you can’t control, but channel that energy into focusing on the factors you can impact, such as the types of companies or funds you invest in and how much you save. On that same token, don’t make your investment decisions only based on past performance. Just because a mutual fund blew everyone away last year doesn’t mean it will thrive this year.

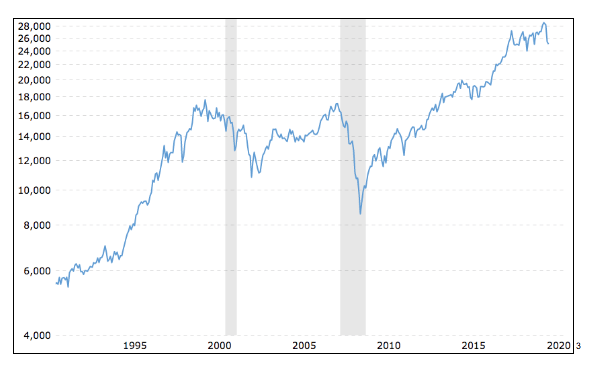

3. Invest For The Long Term

You may want to check financial tasks off your to-do list in a hurry, but remember, investing isn’t a race. It may take time for you to reach your goals, and if you go in with that mindset, you may see more growth and can celebrate the small victories along the way.

4. Control What You Can

It’ll be easier to stay committed to your long-term plan if you control what you can and let go of the rest. That’s why it’s important to clarify your goals, needs, and time horizon and design a plan tailored to your unique situation. Having an investment philosophy and strategy will give you purpose when hard times come. Your reason for investing could be to save for retirement, put aside money for college tuition, or save for a down payment on a home. Knowing your purpose makes the journey more meaningful.

5. Avoid Unnecessary Risk

All investing involves risk, but that is neither a reason to avoid investing nor a reason to throw all caution to the wind. The level of risk you take should correspond to your age, time horizon, and goals. Your portfolio isn’t the place for speculation or bets, and your plan should reflect your risk tolerance.

6. Start Now

Since investing is a marathon, time is on your side. The longer you allow your money to sit in an investment account, the more time you’ll have to reap the benefits of compound interest. Don’t save investing for the future when you feel more prepared. Each year you wait means you’ll need to save more in a shorter amount of time.

7. Diversify Your Investments

It’s drilled into us pretty regularly that we need to diversify our portfolios. Since investing is never a guarantee, you may want to consider investing in various formats and companies to help reduce your risk of loss. That way, if a company goes down or an industry tanks, you don’t lose all your money at once.

Rules To Live (Or Invest) By

See? Don’t you already feel less intimidated now that we’ve covered some investment basics to steer you in the right direction? Investing doesn’t have to be complicated or scary, and you don’t need to learn all the ins and outs on your own. As you pursue your financial future, we at Balboa Wealth Partners would love to help you pursue a positive investment experience and implement these tips into your investment strategy. Give me a call at 949-445-1465 or email me at [email protected] to start taking control of your money and stay informed about your investments.

About Jeff

Jeff Gilbert is the founder and CEO of Balboa Wealth Partners, a holistic financial management firm dedicated to providing clients guidance today for tomorrow’s success. With nearly three decades of industry experience, he has worked as both an advisor and executive-level manager, partnering with and serving a diverse range of clients. Specializing in serving high- and ultra-high-net-worth families, Jeff aims to help clients achieve their short-term and long-term goals, worry less about their finances, and focus more on their life’s passions. Based in Orange County, Jeff works with clients throughout Southern California as well as Arizona, Oregon, and Washington. To learn more, connect with Jeff on LinkedIn or email [email protected].

Advisory services provided by Balboa Wealth Partners, Inc., an Investment Advisor registered with the SEC. Advisory services are only offered to clients or prospective clients where Balboa Wealth Partners and its Investment Advisor Representatives are properly licensed or exempt from registration.

Securities offered through Chalice Capital Partners, LLC, member FINRA, SIPC.

Balboa offers advisory services independent of Chalice. Neither firm is affiliated.